The premise of making a budget is easy: spend less than your income. With costs rising and wages stagnating, surviving on your income is becoming increasingly harder. The average price for a loaf of white bread had risen £0.03 between January 2024 and January 2025, according to a report by the Office of National Statistics. Council taxes have been increased by an average of 5% from April 2024 to April 2025.

With price hikes left, right, and centre, people’s disposable income is becoming less and less. Budgeting is more important than ever. But where do you start and how do you do it?

Learn your incomings and outgoings

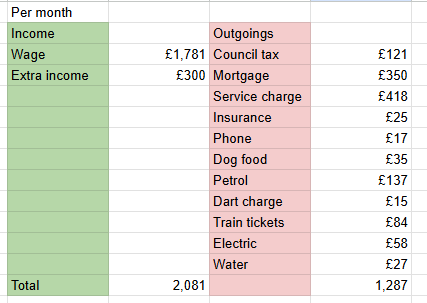

The best way to do this is to create a spreadsheet: use one column to list your monthly income(s) and another to list your outgoings. For example:

This budget sheet shows this single person has £794 left per month for food, and to save for annual expenses such as car insurance and tax, contents and buildings insurances, TV license, and any surprise bills. One-off expenses will also need to be accounted for, such as clothing, takeaways, days out.

How your budget sheet looks will vary massively, depending on your income and your monthly commitments. People with children, multiple cars, daily commutes, a family of people using water, needing food, needing new school uniforms and clothing, and so on will have higher outgoings.

Knowing how much of your money goes where will create a clear picture of areas where you’re overspending, lifestyle creeps, how much you can afford to put away for a rainy day or invest, or overpay.

Analyse your budget sheet

Once you’ve put all your incomes and outgoings in your spreadsheet, you can start to analyse it. Using the example above, this person could save money on paying the Dart charge by creating a pre-pay account, rather than doing one-off payments. That would result in a 20% saving per crossing (£2.00 vs £2.50).

Another area to cut costs would be their phone bill: £17/mth can easily be slashed. Using Uswitch to compare deals, this person could switch from Smarty’s £17 200GB plan to iD Mobile at £12/mth for the same amount of data. A fiver’s a fiver.

As you go through your sheet, highlight the areas where you think savings could be made: you could cut certain expenses entirely or find ways to reduce them. For example, if you cancel a streaming service citing price as your reason, many will then offer you a new deal at a cut rate. Shopping around for new broadband and mobile contracts would be worthwhile as providers give their best rates to new customers.

Ways to gain more control over your money

Once you’ve worked out where your money is going and made any necessary savings, you can begin to plan for the future. Do you want to put away money for a rainy day? Do you want to save up, ready for Christmas? Or do you just want to keep track of your spending?

Keep your budget sheet up-to-date

If the goal of your budget sheet is simply so you can track your spending, keep it updated. Each month, start a new column, input your outgoings, and date the column header. As your budget sheet gets more complex, you could group your outgoings into categories and compare spending between months, financial quarters, or whole years.

Using the budget sheet example above, this person could track train ticket price increases, or service charge increases in a succinct sheet, rather than leafing through statements to check back every time the housing association sends through a price increase notification.

Keeping your sheet up-to-date will also help you notice trends in your spending. You might notice you buy more groceries in the winter, or you spend more on coffee in the summer. The former might indicate you need to make and stick to a meal plan, while the latter finding is just interesting.

Create spending limits

To keep your outgoings lower than your income, you can set limits on how much you want to spend on different categories. You can create a budget for days out, groceries, treats, transport, and anything else you find your money goes towards. You can add these budgets to your spreadsheet, and add colour to make it clear where you’ve kept within your limit or to show overspending.

Some banks, like Starling, TSB, and Monzo, let you open ‘saving pots’ whereby you can transfer money into its own separate space for certain things. Virtual piggy banks. You can transfer your grocery budget across after payday and it’ll be kept away from your main account so you don’t end up spending it elsewhere.

To make things even easier, Starling and Monzo allow you to create a virtual card for your saving spaces: this takes away having to manually transfer money out of the pot into your main account. Pot called ‘Groceries’? Use your virtual ‘Groceries’ card when you pay for your shop at Tesco, Aldi, or Sainsbury’s (other supermarkets are available). This method will also help you keep your shop on budget.

Notice savings accounts

If you’re prone to impulse buying, then increasing the barriers in the way before you can part with your cash is one way to manage your spending. If you can afford to put money into savings, then going for an account where you have to give 30, 60, or even 90 days notice before you can make a withdrawal gives you time to work out whether you really need that new TV or that fancy coffee machine. Of course, a notice account is not for you if you need instant access to your cash, say to pay a vet bill or if your washing machine gives up the ghost.

A notice saver would be ideal for your annual bills. If you know you’ll need £175 to pay your TV license in November, you can notify your provider at the required time beforehand.

From an interest rate perspective, easy access accounts are offering slightly higher rates than notice accounts, so unless you really need a barrier to stop you spending, then you’d be better off putting your savings in an easy access account.

Regular savers

Like above, if you’ve got a spare bit of cash to save each month, consider going for a regular savings account. These accounts offer higher interest than other savings accounts, but there’s a catch: the amount you can deposit each month is limited. On the lower end, regular savers can be capped at £50/mth, like Saffron Building Society’s Small Saver, or at the upper end, this six month fix at 7.5% from Principality Building Society allows you to deposit up to £200/mth. It’s worth having a shop around for the best rate you can, or use Money Saving Expert’s roundup to save yourself some time.

Sticking to your budget

Now that you know your income and outgoings inside out and you’ve set yourself spending limits, make sure you stick to it. Managing your money and keeping on top of your spending is the first step towards building your financial future.